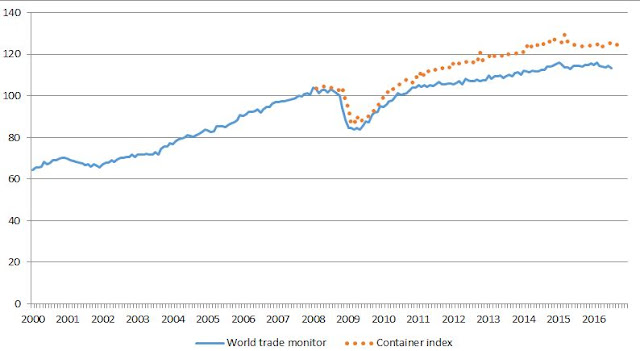

WORLD TRADE: CARDIAC ARREST OR DIZZY SPELL

Haugh et al 2016, Cardiac Arrest or Dizzy Spell: OECD policy paper 18 The concensus view on the trade collapse 2008/9 appears to be changing. In 2009 value chains and protectionism were seen as the magnifiers, multipliers if not culprits of the world trade collapse. A recent OECD study by David Haugh, Alexandre Kopoin, Elena Rusticelli, David Turner and Richard Dutu shows what was claimed and analyzed in On the brink of deglobalization: neither value chains nor protectionsim acted as triggers in 2008/9 and value chains may have been an important factor behind the resilience of world trade (that is the recovery in 2010)